High Court hears legal challenge against Trafford Council’s tax reduction scheme

24 July 2025

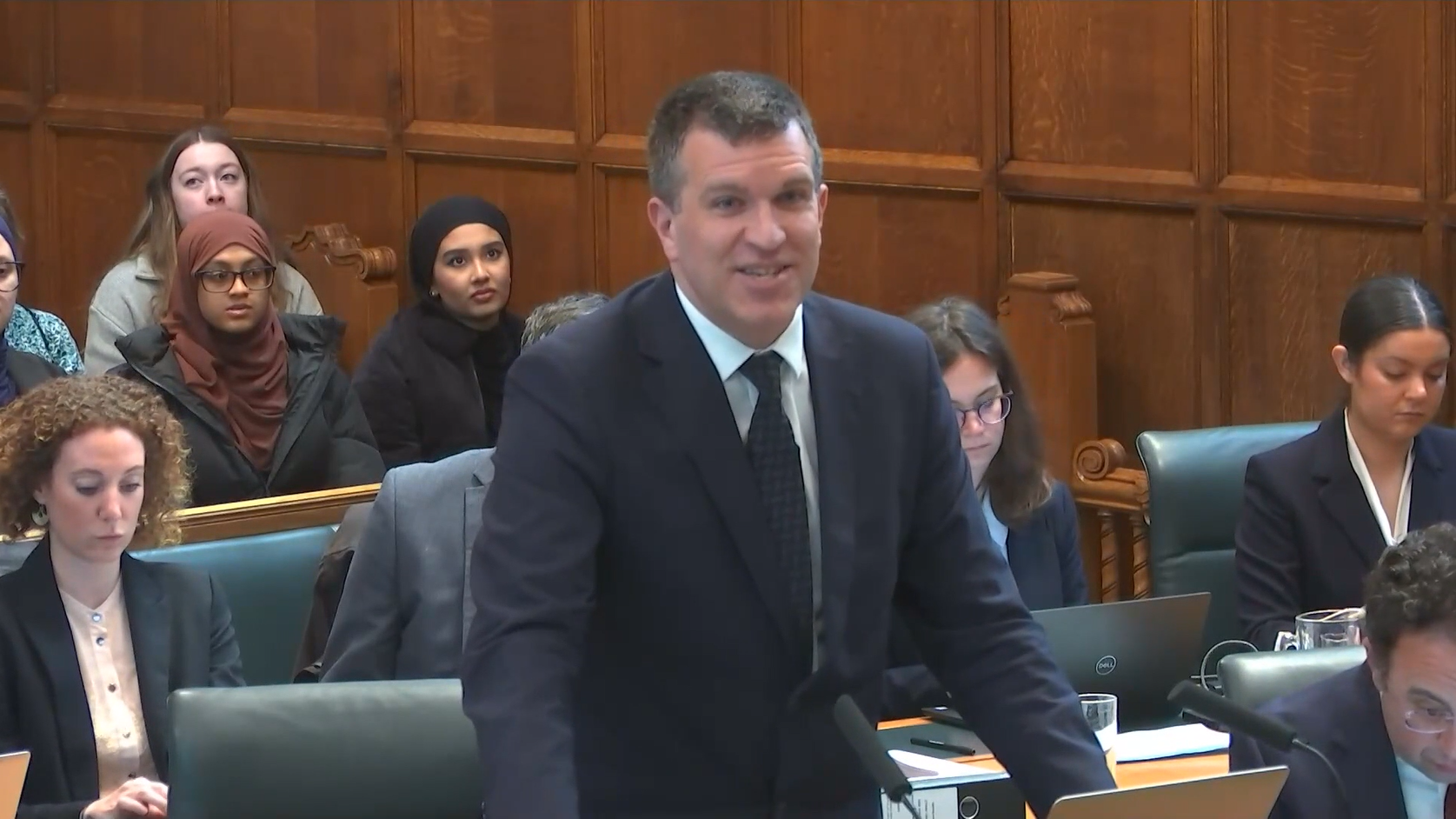

Garden Court North’s Tom Royston represents the two Claimants against the Trafford Council. Credit: Iron Bell / Shutterstock.

Two residents from Trafford, Greater Manchester, have brought a High Court legal challenge to Trafford Metropolitan Borough Council over its council tax reduction scheme, which they saw unlawfully deprives low-income households of crucial support.

Both Claimants, who are disabled or caring for a disabled person, unexpectedly received a large council tax bill earlier this year because of Trafford Council’s new Working Age Local Council Tax Reduction Scheme.

Trafford Council’s scheme, which was introduced in April, has meant vulnerable and disabled people receiving certain benefits now face the prospect of paying hundreds of pounds in council tax. Previously, they did not have to pay any council tax at all.

Garden Court North’s Tom Royston and Henderson Chambers’ Jack Castle were instructed to represent both Claimants by Leigh Day’s Carolin Ott and Sarah Crowe.

The application for judicial review will be heard in the High Court today (24 July 2025) and tomorrow (25 July).

The legal challenge

The Claimants’ legal challenge centres on two key grounds:

1) Unlawful adoption

The council never lawfully approved the scheme through a vote of the full council, as required by law. Instead, the decision was improperly taken by the Executive Committee in December 2024.

2) Discriminatory design

The new scheme uses a means-test that ‘double counts’ certain types of income, such as carer benefits and pensions, which are already considered when calculating Universal Credit awards. This results in some residents appearing better off than they are due to such income being double counted. Thousands of residents have been denied support entirely. The Claimants argue this design is discriminatory and breaches the Equality Act and the Human Rights Act.

Trafford Council has acknowledged that this flaw leaves nearly a quarter of working-age council tax support claimants worse off.

Though some residents have been granted short-term discretionary relief, many continue to receive no support under the main scheme and are therefore at risk if discretionary relief is denied.

In March, Trafford Council also came under fire after it raised its wider council tax by 7.49%, the highest in the country, as it sought ‘exceptional financial support’ from the Government to avoid bankruptcy, ITV News reported.

The Claimants’ requests

In the judicial review, the Claimants are asking the High Court to:

- Cancel the scheme, because it was not lawfully adopted.

- Declare that the way the scheme calculates income is irrational and discriminatory.

- Require the council to fix the flaws in the scheme so that people are not wrongly denied support.

- Award compensation for the harm the claimants have suffered under the scheme.

“I’ve worked all my life and paid into the system. Now I’m disabled and relying on a small pension and Universal Credit, and I was suddenly hit with a full council tax bill,” one of the Claimants said. “I couldn’t understand how I was expected to pay it, and the Council just told me to apply for a discretionary payment. It made me feel like I was being punished for being ill. I’m bringing this case not just for me, but for others who are struggling in silence.”

Carolin Ott said: “Council tax reduction schemes are a vital lifeline for people on low incomes, including disabled people. Our clients should never have been put in the position of having to fight for a fair system. Trafford Council’s scheme not only appears to have been unlawfully adopted, but it also unfairly penalises those who have done nothing more than receive the benefits to which they are entitled. We hope the Court will find the scheme unlawful and ensure Trafford residents get the support they need and deserve.”

Additional media

Leigh Day – High Court to hear legal challenge against Trafford Council’s tax reduction scheme

Solicitors Journal – High Court to hear Trafford tax challenge

For further information, please contact Alex Blair, Communications Manager at Garden Court North Chambers: ablair@gcnchambers.co.uk