Trafford Council’s tax reduction scheme quashed following High Court legal challenge

19 September 2025

The judgment ruled that Trafford’s council tax reduction scheme was both unlawfully adopted and discriminatory against disabled people and carers. Credit: Sakhan Photography / Shutterstock.

Two women who brought a legal challenge over their huge council tax bills in July 2025 have today (19 September 2025) won their judicial review against Trafford Metropolitan Borough Council in the High Court.

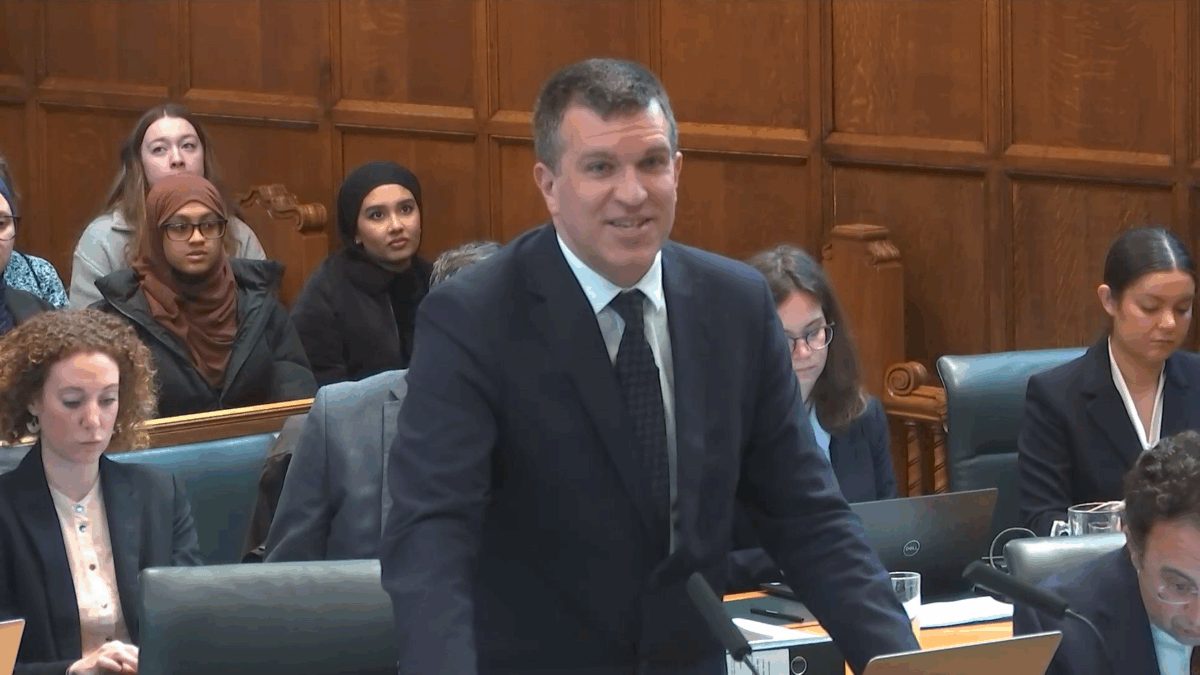

As a result of the legal challenge in which Garden Court North’s Tom Royston represented the two claimants, Trafford Council’s entire working age council tax reduction scheme has been quashed in a final judgment handed down earlier today.

The judgment ruled that Trafford Council’s new Working Age Local Council Tax Reduction Scheme, which was introduced in April, was both unlawfully adopted and discriminatory against disabled people and carers receiving certain benefits. In short, it deprives low-income households of crucial support.

Claimants to receive damages for discrimination

All local authorities must by law operate ‘council tax reduction schemes’, providing means tested reductions in council tax for people on low incomes who could not afford to pay the full rate of council tax: s.13A Local Government Finance Act 1992. These local schemes replaced the old national system of ‘council tax benefit’.

Until 2025, LL and AU had received full reduction from council tax because of their very low incomes. However, earlier this year they suddenly received large bills because of Trafford Council’s newly adopted council tax reduction scheme. Many other Trafford residents were also affected.

Following the claimants’ legal challenge, which was heard on 24 and 25 July, the High Court has ruled that Trafford council acted unlawfully by failing to give all its councillors a vote on the scheme (judgment, §§45-53).

The Court also found the new scheme was unlawfully discriminatory and irrational in its approach to assessing residents’ income (§§77-91). The reason the claimants received such high bills was that some of their other income, such as a private occupational pension and carer’s allowance, was being double-counted. That was discriminatory on the ground of disability, because of the link between the reason for the claimants receiving that income and the protected ground.

The Court rejected the council’s arguments that the problem arose merely from trouble with its computer program, or that the double-counting should be overlooked because the council could use a power to give individual discretionary relief from council tax in problem cases. Rather, it was a defect in the scheme itself. The Court awarded the Claimants damages for the discrimination they suffered.

Finally, the Court found that Trafford Council breached the public sector equality duty in failing to assess the impact of its new scheme on disabled people (§§84-86).

Part of the reason the council adopted the new scheme was to facilitate easier automatic decision-making. However, that caused problems: it became hard to distinguish the scheme’s actual rules from the design of the computer program implementing it, and the council found it hard to explain to the Court how individual decisions were actually made (§30).

Next steps

Trafford Council will likely need to recalculate the 2025-26 council tax liability for a large number of its residents. It will probably apply the previous council tax reduction scheme rules – under which both claimants received, by right, full exemption from council tax.

Key points and implications

The decision shows:

- Changes to council tax reduction schemes must always be made by a full council, never delegated to a sub-body of the authority;

- A public authority which adopts automated decision making must ensure that it can understand and explain how its decisions are reached, and avoid ‘the tail wagging the dog’ (§79 – i.e. must avoid the scheme rules serving the software, rather than the other way round);

- Flaws in a benefit system’s design cannot be ignored just because there exists a power to give discretionary relief from those flaws, especially when they have discriminatory impact.

The case may also be of interest as it appears to be the first decision of a court of record allowing a claim under s.19A Equality Act 2010, a provision introduced in 2024 to provide protection against indirect associative discrimination. In this case, AU’s carer’s allowance was double-counted when Trafford calculated AU’s income. The carer’s allowance related to AU’s daughter’s disability, not to AU. However, the disadvantageous treatment, suffered by AU due to her association with her disabled daughter, was accepted by the High Court to fall within the scope of s.19A.

Tom Royston acted for LL and AU, leading Henderson Chambers’ Jack Castle, and instructed by Leigh Day’s Carolin Ott and Sarah Crowe.

Additional media

Leigh Day – Victory for Trafford residents as High Court rules council tax reduction scheme unlawful

High Court – LL & Anor, R (on the application of) v Trafford Metropolitan Borough Council

Garden Court North – High Court hears legal challenge against Trafford Council’s tax reduction scheme

For further information, please contact Alex Blair, Communications Manager at Garden Court North Chambers: ablair@gcnchambers.co.uk